It Has a Brokerage and Separate Pricing for Retail and Institutional Users However, it is likely that this model for the exchanges has become too ingrained to be disrupted, and many users likely don’t wish to take on the responsibility of maintaining their assets’ security with private wallets. In the future, new blockchain networks and scalability solutions, like the lightning network for bitcoin, could improve transaction speeds and erode the need for exchanges to act as custodians, potentially reducing the competitive advantage of well-established exchanges like Coinbase. Given that trading at a cryptocurrency exchange implies placing your trust in that firm’s ability to safeguard your funds, Coinbase’s reputation as a safe haven is a valuable intangible asset that supports the exchange’s premium pricing. Still, Coinbase presents itself as a safe place to engage with the cryptocurrency economy, and the company is seen as a reliable firm in the cryptocurrency space. Understanding Regulation on Cryptocurrency.Even if no hack occurs, funds can still be stolen. This is an ongoing concern for cryptocurrency investors as the risk remains ever-present. The cryptocurrency exchange industry’s track record as an asset custodian is poor, with billions in client funds being stolen, even without taking the historical price appreciation of the stolen coins into account. While acting as an asset custodian solves the transaction speed issue, it also makes the exchanges a prime target for theft, as users are handing billions of dollars in assets to new firms with limited operating histories and cybersecurity experience.

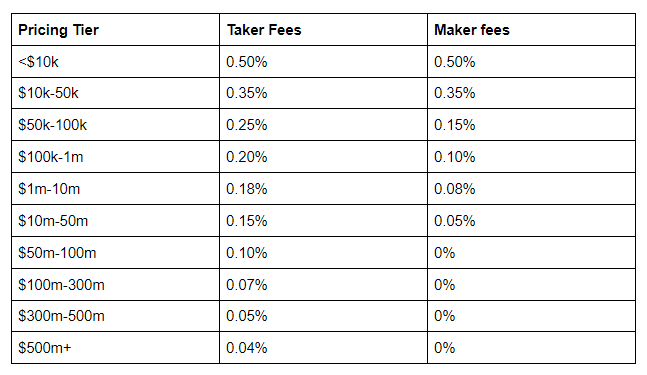

#Coinbase pricing for free#

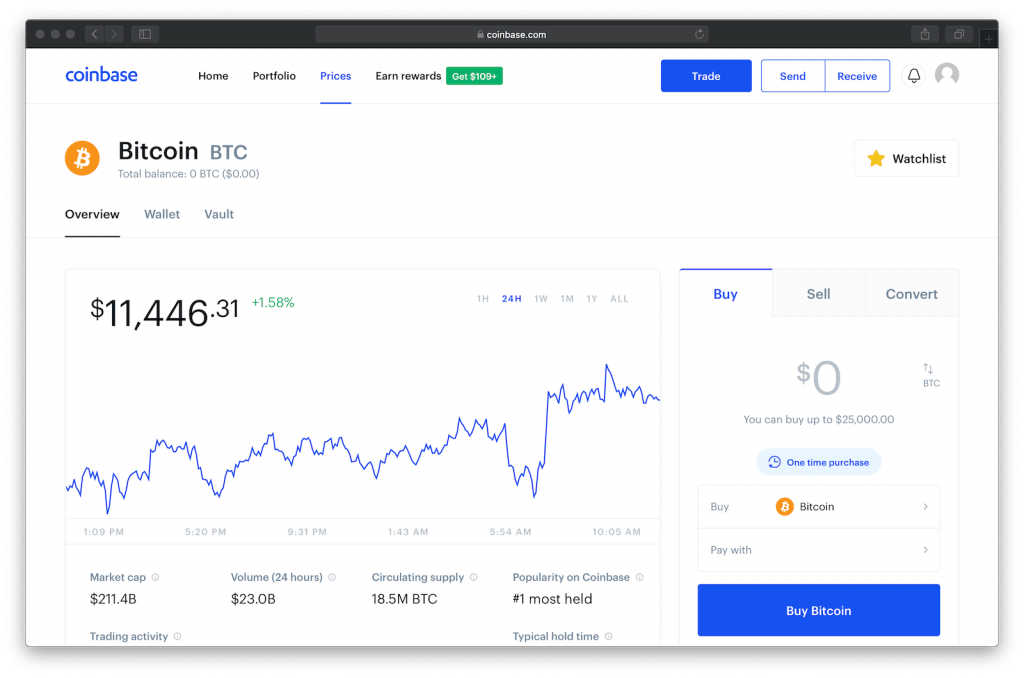

It’s only when crypto assets come or go from the platform that a transaction is logged to a blockchain network, allowing for free cryptocurrency trading without the delays or costs associated with blockchain networks. Coinbase merely notes the trade internally and keeps the transaction off the blockchain until one of the traders withdraws assets from the exchange. Since both ends of the trade are on Coinbase’s platform, the coins involved never leave Coinbase’s wallet. So, Coinbase’s system sees that users transfer their cryptocurrency to the exchange before they begin trading. Accounts registered on a blockchain network are referred to as “wallets,” and moving cryptocurrency from one wallet to another can take minutes or even hours if the network is congested. exchanges in that they often act as a crypto asset custodian as well as exchange-a role that they have assumed to sidestep the technical limitations of most current blockchain networks. Here are a few ways that Coinbase differs from traditional financial exchanges and what that means for investors.Ĭoinbase and other cryptocurrency exchanges differ from other U.S. Asset custody in particular remains a key point of concern for users of smaller exchanges and decentralized financial services, as demonstrated by the theft (and subsequent return) of over $600 million worth of cryptocurrency from the DeFi service Poly Network, and Coinbase’s security track record remains a key feature of the firm.

Coinbase is no exception, as the firm fulfills many roles in its operations and has continued to expand the breadth of its scope through acquisitions and internal investment. regulators, Coinbase ( COIN) is the most prominent of the “compliant exchanges,” a position that has come to benefit the exchange as the cryptocurrency industry matures and regulators become more active.Ĭryptocurrency exchanges typically take on a broader role than traditional exchanges (such as Nasdaq or CME Group), acting as broker, exchange, and asset custodian.

As a publicly traded company operating under the watchful eye of U.S.

0 kommentar(er)

0 kommentar(er)